Posts Tagged “economics”

I can’t believe I haven’t written about this before, but here goes:

Free Market: When we think of the free market, it conjures up the classic example of an open air market where there are a near infinite number of sellers all right next to each other with similar items. If you don’t like the price, simply buy it from the next vendor.

The problem is that almost no market on the planet works like this.

Let’s give a real world example: The Grand Bazaar in Istanbul should be a carpet shoppers paradise. There are an infinite number of carpet sellers all right next to each other with near infinite choice of carpets.

Its a free market right? There is lots of competition. The prices should be great right? WRONG. Almost everyone is getter ripped off. The mark-ups are unreal. Why? Most of the shoppers are not savvy. Buyers know little about carpets, and so if told a price, they think it is fair.

Unequal access to information causes unfair prices. The seller knows they bought the carpet for 10 dollars and tries to sell it to the unsuspecting tourist for the maximum price they can get, which can be 1000+ dollars. That is the profit motive and we expect that….but unless the buyer has adequate information about the product, the market may be “free”, but it is certainly not fair. In this case “free market” almost certainly means “free to make a bunch of profit”.

Information inequality is a huge source of profit in all kinds of industries. When you buy a house, you know how much that house costs, and you know the fee that the real estate agent gets. It is all disclosed at the closing.

What if you didn’t know? What if the real estate agent could negotiate any price they wanted for the house (perhaps they got it at foreclosure), and sell it to you for any price they could get you to agree to (and pocket the difference)? My guess is there would be a lot more real estate agents as it would be EXTREMELY profitable. They could get a foreclosure, and sell it once at full price and not work for the rest of the year.

Why can’t they do that? Because home purchase prices are disclosed as public information. Why? BECAUSE IT WAS LEGISLATED THAT WAY. Without government intervention there would be no price transparency, and so we would not be able to get fair home prices.

Back to our example of the Carpet Shops:

Ok, I’m sure you’ll grant that there isn’t any price transparency at the first shop you go to…but why not go to a different shop? If you shop at a few of them surely you will be able to determine the fair price, right?

No. What happens is that all the hundreds of sellers know that there is no gain to any of them if the buyer knows the fair price…so they ALL quote inflated prices. It is silent collusion. The sellers, whether explicitly or implicitly, are all in the carpet game together and they need to preserve the market.

Collusion is illegal in the US. There can be no fair market if the sellers all collude to keep the prices high. If the government didn’t make collusion illegal, then businesses would certainly do it even more openly than they do now. From our example we see that hundreds of sellers can collude silently without too much trouble.

Think of most industries in the US (insurance, banking, healthcare, telecom, etc). There are only a few major players. It is so easy for them to collude, even if it is not through secret meetings. Industries with a few major players are never “free markets” in the sense we think of. They behave more like unregulated monopolies, which means the consumer does not benefit. This means that the majority of the markets in which normal people deal daily behave more like monopolies than the “Free Market”.

Here is the kicker of the free market: No business wants a free market. Not one.

Why not? In the theoretical “Free Market” (one in which there are multiple players, information transparency, educated buyers, private property protection, a lack of collusion, etc.) consumers gain at the expense of the businesses. For business it is a blanket loss. In business school they taught us that those are unattractive markets, and that you shouldn’t enter them. Let me repeat: Markets where businesses to not able to extract abnormal profits are not good markets.

But some companies want a free market, right? Maybe…if it is not in their core area of business. For instance, Google might want Net Neutrality (unfettered access to anything put on the Internet) because the more people are on the Internet, the more money they can make. Their potential market expands through net neutrality. Let me state it more plainly: For Google to make money off of you, you have to have internet access (otherwise you can’t use their services). Not only does Google want Net Neutrality, I’m sure they would like everyone to have free internet.

What about the companies selling internet access? I assure you they do not want everyone to have free internet. So one company’s “free market” (Google’s) comes at the expense of another company’s profitable market (Internet Service Providers).

“Free Market”. It seems that term means that businesses are free to do what they want, even at the expense of the customer. The Free Market is largely fictional in practice and relative to the company saying the market is free.

When a company advocates the free market, they mean they want the market open for them….which means it isn’t open for others.

To summarize: A “free market” requires all kinds of prerequisites to make it work in the way that benefits the consumer (i.e. us).

____________________________________________________________

The question is: Where do these prerequisites come from?

There is only one answer to that question: The government.

The “market” is not self-regulating, nor does it protect the consumer. The Market is simply the field on which businesses play. They want that field as uneven as possible so they can make a profit. (As a reminder profit always comes from somewhere. It comes from us.)

The government counterbalance is to rig the playing field so that businesses have to compete against each other, which benefits us.

It is not in business’s best interest to compete. Their whole market loses and the customer gains. To go back to the carpet sellers in Istanbul: If the government mandated that all carpet sellers must include the original purchase price on the carpet before selling it so we could determine a fair price (like homes, where purchase prices are public), then in the end there would still be carpets for us to buy (we would lose nothing), but the profit margin for each seller would be dramatically less (they would lose a lot).

The carpet sellers would never agree to lower prices on their own. The government has to force them to do it. If some seller came in and priced fairly, the other sellers would collude to make sure he loses the lease on his storefront or in a completely unregulated situation would simply threaten force against him.

Why do we need the government though? Why can’t WE, the consumers, demand that companies self-regulate? Why can’t we vote with our dollars and just not buy?

I think the primary one is that businesses are organized. Consumers are not. Businesses can collude in the best interests of their market. They are limited in number and focused on the parameters of their market. People are living their lives. We are not focused or organized.

Besides we have already have a mechanism for consumer advocacy…its called government. They are the group that is focused and organized and designed to speak on our behalf. In fact, “on our behalf” is supposed to be the only job they have.

To ask a Machiavellian question: If the counterbalance to corporate power is government power, then what should the corporations do to maximize their power? They should buy the government. Voilà. That is what they are doing.

So. What is the”Free Market”? It is the term companies use to sound like they are acting in our best interest when they are trying to bend the rules of the market in their favor.

Ouch. That’s cynical.

Tags: economics, free market, government

No Comments » No Comments »

Here is a question:

If the government can simply print money…….why do they need to tax us?

They don’t need our money at all. They have the blank check of the printing press at all times. They could simply spend new money into existence, and leave it at that.

As long as they didn’t print so much that it devalued the currency, it would work fine. That’s the same basic issue they have now (even with taxes), so that isn’t much of a shift.

Honestly, I can’t think of an economic reason (can anyone else?).

The cynic in me says there are two good psychological reasons to tax:

- Incentives: If the government taxes one thing (or gives a tax credit on another) it can influence our behavior. That’s what the government does…..governs/influences/controls.

- Government spending and the value of money would be more obvious: People would realize printing more money devalues the money they already have; it is like theft. They would equate inflation with theft, knowing the government printed too much (perhaps for war) and that took part of the value of the money that they’d already saved. On another note, tax evasion would be impossible, since there wouldn’t be any taxes.

Another good question is why we allow governments to run deficits. The flip side of the original question is:

Why do we allow the government to run the printing press? Why not force them to spend ONLY tax revenue?

This would produce an even more dramatic outcome than ceasing the printing press: NO MORE FOREIGN WARS. If we had to pay each year the full cost of our military and were forced to choose between wars and education or health care (or being taxed at 100% of our income so that we’d starve)….we would always choose domestic issues. This would also naturally limit the size of the government (since they’d no longer have a blank check). Government spending could only grow as the economy grew (or shrunk).

Economists argue against this as they cite that governments need to issue debt to undertake large scale activities (wars, stimulus, etc.) that would be impossible if they had to pay for it each year. I understand this argument and agree to a certain extent….and will only point out that Economists are full of shit and can’t predict as a group whether the sun will come up tomorrow. As the new day rose and even into the sunset they would still be arguing about whether the sun was actually there at all.

I say the government and its band of inbred, self-serving economists whose theories have no relation whatsoever to reality (and cause us to have to bail them out) should be limited in a natural way. Perhaps tax-revenue-only spending would be the answer.

I actually know why governments don’t choose this option: it causes them to get overthrown.

In the old days of gold currencies, the governments could only spend the amount of gold they had. They had to go find new gold to fight wars and they taxed until it impoverished their people. The people then overthrew the government.

Then one day a nifty, smart group of revolutionaries figured out that with fiat currency they could get around the spending limit problem and just borrow continuously from people who weren’t born yet. The first groups failed because they got greedy with the printing press, which also impoverished their people…..who then overthrew the government again (notice the theme?).

Then the governments figured out they needed a Goldilocks printing press….print enough, but not too much to impoverish their people. It doesn’t matter though that they know; it is always easier to mortgage the future than it is to pay in the present….and so all governments will succumb to the temptation of the printing press…and get overthrown as they impoverish their people.

I guess the final question, if I were a government, would be:

Why not both tax us and print money?

Why not have the best of both worlds? No need to limit yourself to just one of those two options. Indeed, why not? I guess, unfortunately, that is the answer.

Tags: economics, money

No Comments » No Comments »

I write a lot about economics, and honestly I’ve come to understand a pretty good bit about how power is exerted at the macro level (remember economics is about levers and incentives, not money).

At work (and in life) I have no real macro power, but I have seen people who do. Though I do not like politics from the perspective of Democrats vs. Republicans (since they are largely the same); I do like politics from the perspective of how to influence and how to barter power.

I read Nietzsche’s “Will to Power”; I read Machiavelli’s “The Prince”. I even read the best-seller 48 Laws of Power. Sadly I never read Sun-Tzu’s Art of War.

Here is some truth about Power:

– I will never have any….at least not enough to truly influence events on a macro level. Influence at a local level is nice; however, it will not likely change the general circumstances of my life.

– Money is Power. Information is Power. Guns are Power. I will pretty much never have those in any significant amount (and I don’t want them).

– We aren’t even in the game. We are pawns. The top 1% control 42% of wealth in the US. The flip side is that 40% of the population vies for 1% of the wealth.

– We will never make enough money to escape the hedonic treadmill. As our salary goes up, so will our lifestyle. Some people make enough to get our of this trap…most don’t. Working hard is not the answer.

– We will not be smart enough to “game the system”. There are a few people at the bottom who draw social security disability that shouldn’t or get too many food stamps, but they are still certainly not the winners. For us to begin to “game the system” at a higher level we will need more power/information than we’ll likely ever have.

So what is my advice?

CUT EXPENSES…and save.

That’s it. You thought it was going to be some great revelation, but it isn’t. We don’t have access to that kind of power. We play by the rules; we don’t make the rules.

That’s the best most of us can do. We cannot avoid taxes since we have no deductions. There is no get rich quick scheme and we’re always faced with potentially crippling medical/education/unemployment/whatever costs.

We will not get ahead by making more money; our lifestyles will go up in lockstep with our salary, but we will be no better off (after about 40K there is no well-being bump from increased earnings).

We cannot pick stocks. We will not win the lottery. We will not become rappers and sports stars. Most of us will never even become managers or VPs.

There are only two sides to the equation: Expenses and Income. We cannot affect our income in a way that will allow us to get ahead (where did your 2% raise last year go?), so that leaves Expenses…the only thing we control.

To get more concrete, it is FIXED expenses that kill us.

– A house. Don’t buy a big, expensive house. A house is not an investment; it never was. It is a place to live. Living in a smaller house with a smaller monthly payment is key. A smaller house will also help your energy bills.

– A car. Don’t buy a nice car. A car is a waste of money. Drive the worst car that your lifestyle will allow you to drive…then pick one a little crappier and older. When you’re out of work and you have 15K extra because you didn’t buy the brand new Infiniti…you’ll be happy. On a related note, pay cash for your car. Do not take out a loan. The car you can afford is the car you can pay for.

– Cable. I fucking hate cable and as soon as I find a way to watch sports online, I will be ditching cable. I can already watch all the shows I want online. I can get movies (which I can never find the time to watch anyway) through Netflix. I still find it frightening that I drop nearly 100 bucks a month to watch a few sporting events.

– No debt: Don’t get trapped servicing debt, credit card or otherwise.

– Student Loans: Don’t go to a good school. They are expensive and will, at the best, get you a good paying job…which will not be all that beneficial for you. It will be much more beneficial to have no debt and be a hard worker, which will make up for the fact your didn’t go to a good school. However, do go to a GREAT school if you can get in (Harvard, Yale, MIT, etc.). This is where the people that make the rules go to school. If you become tight with them it is definitely worth the money.

What can you spend money on?

– Flat screen TVs, expensive beers, going out to eat, etc: I’m not saying go crazy, but one time purchases can always be stopped. Next month simply don’t buy a flat screen TV. Easy enough. The expense is gone. This crap about the American consumer being in trouble because they spend too much of frivolous junk is a load of shit. Those kind of expenses, unless you have some sort of psychological shopping disorder, will not get you in trouble. It is the recurring expenses, FIXED expenses, that will cause you to go bankrupt.

– Health Insurance: Unless you’re 20 years old and invincible…buy some, at least a high deductible indemnity plan. Just wait till you get unlucky and drop 100K on open heart surgery…then try for the rest of your life to recovery economically (and medically) from that.

So that’s it. That’s being rich: spending less than you make and having a piece of mind about it.

It occurs to me that I’m giving the above advice to myself and others in my income level, which would be pretty much everyone in maybe the 50 – 90th percentile of earnings.

If you are below that (and most people will be below the 50th percentile by definition)….its still good advice in general; however, there is very little you can do. Sorry.

Your expenses are likely already cut (except on crap like cigarettes and lottery tickets, which you should definitely cut out), and your income will likely never rise high enough to give you significant options. The US has poor income mobility, especially at the bottom end.

Not that any one person can’t rise above their station in life. We can. It just isn’t likely to happen on average.

There is advice I can give; however, it isn’t likely to have any affect for a good number (if advice could help people we’d all be millionaires as there is plenty of it out there).

It is not that I write off the bottom half. I have been in it (and may be again), and there are plenty of good, nice hard-working people there.

The fact that so many have so few options is what is troubling…not for me, but the future of the country and our children.

Tags: advice, economics, power

No Comments » No Comments »

There. I said it.

And I mean it. Not that certain stocks are a ponzi scheme….the entire concept of the stock market is a ponzi scheme.

Think of all the people that work in industries related to the stock market……are you thinking? There are newspapers, magazines, and entire TV channels that employee only people talking about the stock market all day.

And they all have no fucking idea what they are talking about. They are so spectacularly wrong, even weathermen are more accurate than these people….and if weathermen are wrong you simply get wet. When all these clowns are wrong the global economy is wrecked.

Let’s examine some fundamental truths about the stock market:

Stock shares are fiat money (ie. THEY ARE WORTHLESS): A company issues stock, but what is a stock? It is simply debt, and they raise public debt (issue stock), because it is cheaper than bank debt. If they could raise money cheaper simply by borrowing from a bank….they would. They issue stock debt to YOU because it is cheaper than asking a bank.

Why is stock so “cheap”? Well….because it is FREE. Bank debt is harder to get out of. If the company fails, the liquidated assets of the company will go first to the banks (before the stockholders). Since debt is concentrated with the bank, they can ask the company to do things (stock ownership is dispersed, so stockholders (unless you’re a really large one) aren’t well organized and have no power).

Do you understand? Companies give you a piece of paper (you can call it stock or you can call it currency), that gives you no charge on the company (you can’t trade it in for any product), puts you last in line for liquidated assets if the company goes bankrupt, and is worth something only because other yahoos agree to pay you for it (but it has no utility).

Stock is simply currency that a company has issued (like the government issues US Dollars)……except you can’t buy anything with it. You simply own it, like art or baseball cards, until someone else agrees to buy it from you.

The exception to this is companies that issue a dividend (you do actually get something in this case); however, the companies that don’t issue a dividend are still bought and sold very regularly (Microsoft didn’t for years and Google still doesn’t).

Stock price changes do not make (or lose) any money for the company:

Companies issue the public debt of stocks once, at the IPO (Initial Public Offering). At the IPO they sell a bunch of shares to us and we give them money. They then spend that money. They gave us “shares” (which are worthless; they are not “sharing” anything)…..we gave them money.

The stock market is simply a second hand swap meet.

Stocks are to companies as used cars are to car makers……they make NO MONEY when their stock goes up (just like a sold used Toyota makes no money for Toyota).

People investing in stocks do not help business or the economy:

You’re not creating jobs (except in finance) or helping the company; stocks (at their best) are supposed to reflect the underlying health of a company; they do not CAUSE the underlying health of the company.

Here is a thought experiment:

If everyone bought the stock of a company, what would the outcome be? Nothing except an inflated stock price. No one really has anything. Nothing has been produced (except fees for finance companies).

If everyone bought the PRODUCT of a company, what would the outcome be? Well, they would have something (the product), and the company would get that money. That is something you can work with.

Stock market prices do not predict anything:

Stocks may reflect some things, though what they reflect I’m not sure (human psychology about the markets themselves perhaps?). The smartest PHDs in the world have thrown every algorithm in the world at stock data. It is random from one day to the next.

The only proven way to predict the stock market is to have INSIDE INFORMATION. The rest of us will never do better than the market in general except by luck.

The capital gains tax reduction on stock investments is simply a tax break for the rich:

The average person gets almost no income from stocks; functionally we don’t really care about the capital gains tax rate….because we don’t have any significant capital gains.

1 percent of all taxpayers collect over two-thirds of all capital gains; that top 1% gets a tax break on their income; we don’t. We pay 33% or whatever, and they pay 15% on their capital gains.

It is said that a reduced capital gains tax encourages investment. Perhaps (I won’t go into the economic arguments here)…however, in the labor vs. business struggle…..labor has really been losing out over the past twenty years. Its hard to have sympathy for the capital gains crowd (since they just wrecked the world economy).

What is good for the stock market is not what is good for America:

Correlation is not causation. It is true that if the underlying reality of the the economy is good then you’ll probably have a decent market return; however, you CANNOT WAG THE DOG in this case. Propping up the stock market will not cause a fundamentally sound economy. It will simply cause the stock holders to get rich…while the underlying fundamentals (labor, jobs, etc) continue to worsen.

Chew on that.

Tags: economics, stock market

No Comments » No Comments »

Rent Seeking:

Not to be confused with simply paying rent….rent seeking is an economic term to describe extracting an economic “rent” (i.e. some sort of value) on a transaction where the party adds no actual value. Another definition (from investopedia.com) is when a company, organization or individual uses their resources to obtain an economic gain from others without reciprocating any benefits back to society through wealth creation.

This is easily applied to the current financial industry. It is a simplification; however, if the high-finance industry simply ceased to exist, no harm would be done. They don’t actually produce anything…they simply extract rent as a piece of other, hopefully productive, activities.

Finance claims to do risk assessment. That is almost laughable. They failed to properly evaluate the risk they themselves created with their fancy debt instruments……and we ended up bailing them out. If I were them….and they were smart….I would fire themselves. They are obviously incompetent and a self-contradiction: If their purpose is to mitigate financial risk and they themselves are the largest risk to global finance…the only logical conclusion is to close their doors and go home.

Rent seekers are bad. They produce nothing and extract a “rent’ (i.e. are a burden) on people who do. If the rent seekers get bad enough….the producers simply stop producing.

Wealth creation:

Who then are the non-rent seekers? What actually is a productive pursuit? This is the more interesting question by far.

I argue that productive pursuits improve lives.

Productive: Growing food is productive. Building houses is productive. Air conditioning, plumbing, refrigerators.

If you have these things….your life will be better. No doubt. Black and White. It gets more difficult though. Some things are necessary to make things that make life better.

Compliments to wealth creation: Roads, electricity, computers, telephones, etc.

These are necessary to make the things that make life better. It gets even harder.

Ambiguous: What about lawyers? Are they navigating the law for the wealth creators so they can do their job or are they using their special knowledge of our byzantine legal system to bend the rules in their favor….to rent seek?

What about the health insurance industry? Are they helping people get health care or are they using their legally created special status to rent seek on people trying to get health care? If the whole industry simply disappeared, would it really matter?

What about service industry jobs? Are barber shops and nail salons creating wealth? No. They are not. They are compliments. Theses industries (and many others) do not create wealth; they exist solely because of the excess wealth of the industries which create things that make our lives better.

Only when the first dude created enough excess wealth from his labor would their ever be demand for a service job like laundry or cleaning.

After all…..imagine a society where everyone is cleaning for everyone else and cutting their hair….where do these people live? What would they have to clean if nothing were being produced? The service industry exists as a compliment.

So……I’ve probably lumped over half (forgive the imprecision) of US economy into non-wealth creating pursuits. Most people work in service or rent seeking industries.

If this is the case, what about the US economy with its dwindling manufacturing base and increasing service sector?

Can a purely service economy exist?

No. I don’t think so. Not for any extended period of time and be prosperous.

There are a precious few things that truly make life better….and the vast, vast majority are all actual THINGS. They are things enabled by advances in technology.

That’s what true wealth creation is: Technology enabled stuff we produce that makes our lives better.

Everything else exists on the coattails of those very few items, because without those very few items all the other stuff wouldn’t NEED to exist.

Example: It might be true that the greatness of the Seinfeld TV show made lives better. I could agree with that; however, without food, a roof, warmth, indoor plumbing, electricity, etc….no one would care about TV.

What does all this mean?

1) Technology is the basis of everything that makes our life better. Invest in it. Waste money on it if needed (don’t waste money on foreign wars).

2) Make stuff that improves lives. Everything else is either service for those that make things…..or rent seekers. If you don’t make things, you’ll soon be lining up to be friends with those who do.

Tags: economics

No Comments » No Comments »

I wrote last time about the concept that Goldman is employing: “all that is not illegal is permissible”.

When they say they did nothing wrong, they mean they did nothing illegal.

If some judge finds that what they did IS illegal, they will find another judge. If all judges find what they did was illegal, they will make new laws. If that doesn’t work, they will simply re-organize under some other legal structure and continue to do what they wanted in the first place.

So……how do you win a game?

I assure you it is not by being the best at something. Hard work is a VERY difficult way to win. It is a high effort strategy that, in real life, doesn’t often work.

Why can’t you win by being the best and working hard?

Because the rules change (and there is always some fool out there willing to work harder).

In sports, the rules stay mostly the same; the game is defined. We enjoy the fairness; we scream when the rules (which are limited since the game is well-defined) are broken.

In life, the rules can change; the game can change. There is no “score”, no tidy buzzer at the end that tells you when its done. Those who win are those who make the rules.

Goldman can use its influence, its special knowledge, and its money….to make the rules or change them if needed. They don’t break the law because they make the law.

When I was in business school I was taught attractive industries are those with high barriers to entry.

Here is how you make your industry attractive: bend the rules in your favor.

Capitalism in the United States is not about competition and free markets. It is about manipulating the rules of the game in your favor. That is the easiest way to win any game. It doesn’t require nearly as much hard work and is a much better guarantee of success.

Think about it: How can you win long term if there is a level playing field? The best strategy is to un-level the playing field….not to work harder. If your long term strategy is working harder, you won’t be on top long…there is always some idiot out there willing to work harder. If your long term strategy is hard work, you will kill yourself doing it.

I think Goldman’s strategy is simply how capitalism in the US works: its a plutocracy. The rich are bending the rules to make sure they stay rich. The rich are largely smart, and we are busy working hard, so we don’t realize the bait and switch.

I remember the story of Mickey Mouse from business school. Whenever the early Mickey Mouse movies get close to lapsing their copyright and entering the public domain, Disney simply gets the law changed to extend the copyright.

The pharmaceutical industry peddles treatments that work better than placebos….the treatments don’t have to work better than sunshine, getting friends, eating healthy, taking vitamins, exercising, etc….and often they don’t, but they can’t sell or patent exercise.

They even invent new diseases to match “cures” they have found (had you heard of erectile dysfunction before Viagra?). You rig the game. If you can “cure” erectile dysfunction, then you need to make it a disease. Shyness is a disease now too (social anxiety disorder).

In short, the patent system CREATES the current pharma industry. The industry manipulates those rules to protect their profits; they don’t want free markets. Its much more profitable to define diseases or massage the drug approval process regulations.

Also, no business wants free markets……they want free markets when it suits them…and then closed markets when it doesn’t. The patent system creates a closed market; that’s good for copyright holders.

Multi-national corporations (who are also quite well-connected and resourced) want free trade…because it allows them to move goods and labor unfettered. The only group you can bet for sure will benefit from that arrangement…is the multi-nationals themselves.

Who do you think writes these laws? The industry almost HAS to write them; because they are the only ones with enough expertise to do so. Would you want some blowhard politician writing laws about an industry they have never even worked in? The industry groups draft the laws and try to get the politicians to sponsor them.

Banking is the ultimate special privilege industry: It gets to create money…and he who creates the money, makes the rules.

If you’re looking for a lesson in my rambling here it is this: The winners make rules. Everyone else whines about working hard.

If you beat me 100 to 2 in basketball and I re-define winning as having the lowest score….then I win. It doesn’t matter how good you are.

Tags: economics

No Comments » No Comments »

Basic assumptions are rarely questioned. One has to be pretty astute to even understand what the basic assumptions behind something are. If you don’t know; you can’t question. Even if you do, you have to be inclined to care.

I’d like to question two basic assumptions today:

Assumption 1: Kids should go to college:

I disagree. Some kids should go to college (by college, I mean a 4 year degree). For most it is a gigantic waste of time/money and they should stop being misled into attempting it.

So which kids should go? Speaking practically, the ones that should go are the ones that are currently getting something out of it, as in the ones, at a minimum, who are graduating (never mind whether the degree is useful).

If you are in the bottom half of your high school class…don’t go to college. About two thirds of you never graduate. 70% of high school graduates now go to college. Those numbers don’t add up. Why go? It leaves you in debt, and out of the workforce (a year of good work experience is worth far more than 1 year of random classes). It is a waste of time.

With our battery of endless aptitude tests and 12 years of high school grades, we know with a high degree of accuracy which students will do well in college. Quit misleading the others into thinking it is worth their time to go. It is dishonest if high school kids aren’t told that college isn’t always a good idea. It is simply avoiding reality.

That being said, people should always be able to bet on themselves. If you want to go to college anyway, and beat the odds….please do. Life is full of people beating the odds; however, make no mistake: the reason we like those stories so much, and why they stick in our mind, is because they are exceptional, because they are out of the ordinary. We all want to believe we can beat the odds; it makes us feel good.

However…..We can’t all be above average. That is a fact. We are not all future managers, CEOs, sports stars, rappers, singers, etc. Those at the top of their profession are compulsively dedicated and often very talented. Most of us are just not willing to work that hard and often don’t have the natural talent; accept it. Also, from a statistical point of view, we just can’t all be at the top of the pyramid. It is numerically impossible.

I’m not going to post here (lack of time) on what we do about it…the fact that inequality of all kinds simply exists, and it must exist, whether it is politically correct to say so. I’ll simply say that if you want to be above average, you need to be aware enough of your position to realize that you can only be so because others are below average (you depend on them). Be thankful they exist, and treat them well; tomorrow you may be one of them.

UPDATE 6/10/2010: Someone else (NY Times) had the same idea I did.

Assumption 2: Economic growth is good:

On average the US economy grows about 3% a year. That seems good, right?

Yeah, its good in many ways. Would 6% growth be better? Sure.

No one really questions whether growth is good. “A rising tide lifts all boats” right? Uh…maybe. Or a rising tide sinks those without boats.

Anyway, I’m not even going to broach that subject here. Let’s take a step back…even further…way further…to the concept of 3% growth itself. Is it even possible to grow at 3% forever?

No.

People are quite poor at understanding exponential growth. We tend to conceptualize growth as linear; its a good rule of thumb that applies in most situations.

Does 3% growth look like this?

No. That’s linear.

Here is 3% growth in a series of 150. Think of it as a series of 150 years (but it is simply units, could be days, or miles, or whatever).

That’s a neat upward curve. Perhaps we think it would be good to grow like that? The fact is that we do grow like that for the most part.

Here is 3% growth in a series of 350.

Here is where we start to see the issue. It plods along at almost nothing for majority of the series and then towards the very end, it shoots off the chart (no pun intended).

That’s not sustainable. All systems like this eventually collapse. A good analogy is bacterial growth. It looks like this as well, and then, when it is about to shoot off the chart and grow out of the petri dish…it exhausts its food in a fit of growth, and the colony dies….quite quickly.

Growth requires input….we are growing something (the economy), and we need raw materials to make that happen. Those raw materials MUST eventually deplete, as does the food in the petri dish.

Even if you give the bacteria more food or a bigger petri dish, it doesn’t matter. The growth curve will eventually catch you. You won’t be able to shovel in inputs faster than the growth.

I’m not being all environmental. I’m saying it is simply impossible, under any set of circumstances, to maintain 3% growth indefinitely. We need to accept that reality and plan for it.

Speaking of reality: The concept isn’t “Save the Planet”. Trust me; the planet isn’t going anywhere. We’re not even trying to save life on this planet. Life is pretty resilient; it survives. “Save the Planet for Humans” is a more accurate. I guess that doesn’t fit as well on a bumper sticker?

Tags: economics, education, environment

No Comments » No Comments »

I have some things to share with the 7 or so people who might read my website:

Why I am apolitical:

I’ve always stated that I am apolitical, neither democrat, nor republican, nor centrist, nor libertarian. But I have strong ideas about politics and the role government can have in our lives…very strong ideas.

So as I watch the bailout of the financial system and the endless debate on healthcare reform everyone agrees in theory needs to happen…..I ask myself: Why am I not more political? Here is why: because there is no substantive difference between the democrats and republicans.

We think of them at opposite ends of the ideological spectrum, but they are not. They argue loudly about small difference they make seem big while rarely addressing anything substantive.

I’ll use the example of the financial system bailout: Both the republicans and democrats wanted to bailout the financial sector; they just argued about the amount (both amounts being very large) and how to spend the money. The Republicans started the bailout and then the Democrats inherited it, and continued the same basic policy. Neither party addressed why it happened in the first place; no one (except maybe Ron Paul) wanted to discuss the structural issues of a monetary system based on debt and a fiat money controlled by unelected officials making decisions behind closed doors (the Fed). Neither party has addressed the “too big to fail” issue (not only that, but the big financial companies have used the bailout money to buy up the smaller companies that failed during the crisis; they’ve actually become bigger).

Here is another example: 9/11. Both parties wanted retribution. No party was brave enough to say: ” 2993 died today in a terrorist attack. 6,744 people die a day on average everyday, so to put that in perspective, America is not under attack. This was high profile and a great tragedy, but to upend our way of life, to start long costly (very costly) wars on foreign soil with unclear means of success in which more men and women will certainly die…..to restrict and lose, in the name of increased security, the very freedoms and civil liberties we would claim to go to war to protect…..this is not acceptable. If this is our response to terrorism, then certainly we have already lost.”

This brings me to my next point.

Why Republicans want healthcare reform to fail:

I do not think the Republican’s opposition to healthcare reform is 100% genuine and in the interest of their constituents (even if you include the healthcare companies as their constituents). Republicans want healthcare reform to fail because if the Democrats pass the reform the people want, the Republicans may not see the inside of the White House or a majority in Congress for a generation.

The point, is that neither party has a genuine interest in doing what is best for us….they have an interest in getting re-elected. They pass laws based on that and little else. Democracy works because the two can definitely overlap; if you pass laws people want, you get re-elected…..but their are other ways to go about it as well: money can also get you re-elected (so pander to companies); being less-bad than the alternative can also get you re-elected (just bash the other party and say great things about yourself). In short, there are alternative ways to get re-elected.

This brings me to my next point.

Why I want to go back to school:

I’ve been kicking around the idea of going back to school to get a PhD in Economics. In the long term, its a good life to be a college professor, and in the short term it would allow me to follow these ideas to their natural conclusion.

Incentives.

People are neither good nor bad; they act, en masse, according to the situation in which they find themselves. Modify the incentives and you modify behavior.

I would like to study some form of behavioral economics that would allow me to construct a system of incentives to help people avoid all these situations.

The economic system in which we operate works together with government/law to create the set of incentives that control our lives. I would like to draw lines in the sand, to establish some facts and some subtlety:

The free-market can fail to reach optimal outcomes. We must accept that these textbook perfect market conditions don’t exist in the real world, and even if they did they would still produce monopolies, corruption, inequality, price fixing, etc.

Economy doesn’t exist w/o government….therefore government has a role to play…not as a spender of money, but as a regulator, a system-maker. We need to accept that the invisible hand of capitalism produces anxiety, inequality and pits us all against ourselves. This produces crime, mistrust and ill-health. We don’t want to live in a country like that.

GDP is a horrible measure; lets replace it: It promotes over-consumption, doesn’t differentiate between types of spending, and you can’t subtract from it. Here is an example: The US has the largest economy in the world with a GDP of 12 trillion (per year). I can turn the tiny nation of Uruguay (or any country for that matter) into the largest economy in the world: Let them borrow 13 trillion dollars from someone and spend it all on rat poison next year. They will be horribly in debt and have a country full of rat poison…..but they will have a 13 trillion dollar GDP. You might be thinking “that’s not how it works, surely!?!?!”…..but oddly enough, it is.

Monetary policy is the basis of our society, because money controls/influences most of our actions. Fiat money created by debt is the structural issue that has caused our current crisis, and yet few seem to understand that (so no one addresses it). Money systems fail (and empires fail with them). To create a lasting society, you have to create a lasting money. Our current system is unsustainable; it allows the government to confiscate our wealth through inflation. Taxes are cheap in comparison.

I would like to clarify these ideas, to write my own Das Kapital; furthermore to elaborate it using agent-based computer modeling so that it isn’t all theory, you could potentially model changes to law/monetary policy to see the potential effect. It would be akin to what weather forecasters use; imprecise, but better than nothing.

What do you think? Quit my job and go back to school or continue as is?

Tags: economics, government

2 Comments » 2 Comments »

I pride myself for being a hack, weekend economist. I admit it isn’t going to make me rich, but it is interesting.

It is easy, at first pass, to answer the “why did we bailout the financial sector” question. The answer is because they are rich and have powerful lobbyists, and there is intuitively some truth to the claim that without a finance sector to grease the wheels of the economy, that it would grind to a halt. So whether or not the companies are to blame for their own mess; we need them, so we have to save them….I guess.

But why do we need them? Why, if too much credit got us into this mess in the first place, was there a deafening cry from Washington to get credit flowing again. How could the disease be the cure? (BTW: that was the premise of the bailout: We want this bailout money to go towards lending. Lending had stopped because risk couldn’t be accurately gauged.)

The question then becomes, “Why do we need lending?” What is so important about the ability to keep credit flowing that we literally cannot do without it, even for a little bit, while the financial sector shakes out and healthier companies (those without exposure to bad debt) take the place place of the old financial sector? How long could that take? A year?

Why the cry from Washington of “We must act NOW,” as in RIGHT now. They passed the TARP bill almost immediately with no rules attached, and started handing out money willy-nilly….compare that with healthcare: In healthcare there is a near endless debate over a change everyone agrees in theory needs to happen (overhaul of costly system) and for which there is a moral imperative (richest country in the world with 47 million uninsured citizens)….then TARP: No debate, no moral imperative, very costly, no oversight/enforcement, benefits only a few. How did that happen?

I think I figured it out, and I figured out a few other things in the process:

Money is debt. That is why we need debt. Without it there is no money….literally. 95% of all money in circulation is debt. If all that debt were paid off……..there would be almost no money, and thus no economy.

The government doesn’t create money in our monetary system. The banks do. They do so through loans. To simply a bit, when you take out a loan, that is new money. It isn’t taken from another person’s deposit and given to you. The money didn’t exist before. When the bank credits your account for the amount of the loan the money comes from nowhere…it is created with a digital keystroke. Money can be thought of as a series of IOUs (debt), which, if they are all paid back….equals zero.

(This answers the question as to why banks are so profitable. They don’t actually need any money. They give you money they just created from thin air, and then you have to put up the house/car/etc for collateral (which you may end up losing to them) and pay them back interest. Interest on what? They didn’t risk anything…..they didn’t actually put up any money on their side. They don’t stand to lose much, since they can buy insurance on loan failures and they get the collateral if you don’t pay.)

So back to the bailout: Why must the debt keep flowing? Why MUST banks lend or the economy comes to a screeching halt?

Two reasons:

1) Loans are always being paid back (which destroys money; money lent is money created, money paid back to the banks is money destroyed), so for the money supply to continue to increase, there must always be more loans going out than there are payments coming back in. If loans don’t go out, the money supply contracts and deflation occurs. Deflation is a hard loop to get out of, and is definitely bad for the economy.

2) If I borrow a dollar from you and then you borrow a dollar from me and we later pay each other back, then all is good. But what if we decide to charge interest (which banks do)? There is only two dollars in our economy…the money simply doesn’t exist. One of us has to go bankrupt because we won’t be able to pay. The only way to pay is to borrow money from a third party (or borrow more your original lender). This is how our economy works. You always borrow the principal of the loan, but you must pay back principal plus interest. Where does the interest come from? We borrow it (because that is pretty much the only way to create money). Individuals may be debt free; that is true…but the system as a whole must always borrow an escalating amount because the system must always pay back principal plus interest on the original principal or people (the system) goes bankrupt. That is what we are seeing now.

And that is why lending must happen. That is why we saved the financial sector. Debt is money. Without the debt/credit/banks….there is no money and no economy.

I think if everyone were a little more educated on how our money system works this would be a better country to live in. All that shit they do in Washington is just smokescreens and old, self important white men thinking they know something.

“Permit me to issue and control the money of the nation and I care not who makes its laws.” — Mayer Amsched Rothchild

“If the American people ever allow the banks to control issuance of their currency, first by inflation and then by deflation, the banks and corporations that grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers occupied.” — Thomas Jefferson

Tags: economics, money

No Comments » No Comments »

Sometimes I think so. It can’t be true though. IQs are going up (Flynn Effect). I do think people are uniformed, but certainly people have always been uninformed. With the Internet providing more information that we can ever possibly wade though, and college attendance at an all time high, there is no excuse for being uniformed…moreso I believe that since all that information wasn’t even available in the past that people are actually more informed now that ever.

So…people are smarter and more informed than ever. Why are they such idiots?

Hmm….well, maybe they are informed, but informed of the wrong information (which makes them seem dumb)? That is a hard hypothesis for me to get my head around since if I were also misinformed then me commenting on other people’s misinformedness would be making the problem worse.

I know people are misinformed (including myself); however I know that; so not being an idiot might simply be knowing that you don’t know. A healthy skepticism (even of yourself) is not exactly inspiring, but it is a useful bullshit detector.

I think people are apathetic. They may be relatively well informed and intelligent; they just don’t give a fuck. Republicans or Democrats? Why does it matter since they both pander, lie, and misrepresent? Fox or MSNBC? Doesn’t matter. They both spin.

You just give up maybe. After all, you still have to get out of bed in the morning…focus on what you can control.

Anyway, my bullshit detector is stuck permanently on, so here you go:

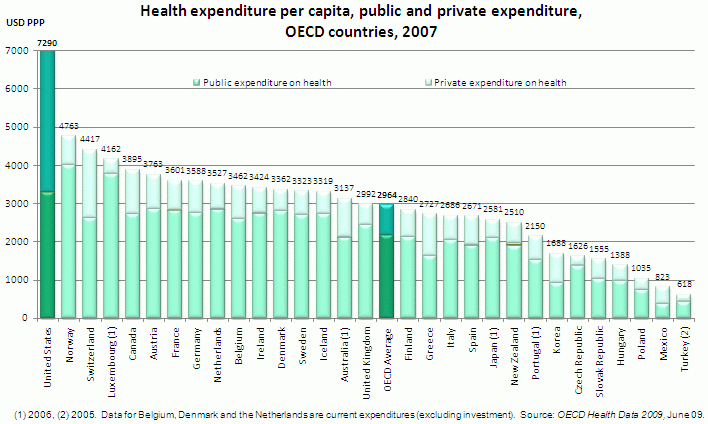

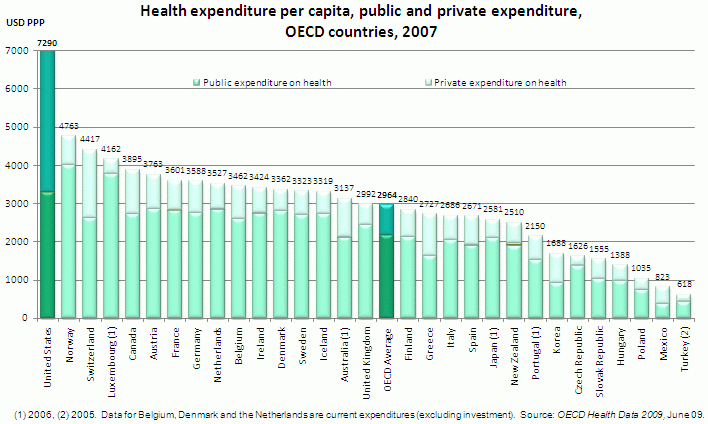

Health Care:

Lots of debate these days about this.

Spin: “National Health Insurance will ration my care. There will be long lines. I’ll die on a government list waiting for my surgery.”

Fact: Yes. Your health care will be rationed. HOWEVER, IT IS ALREADY RATIONED….by money. The rationing goes like this: If you have money, you get care. If you don’t have money, you don’t die on a government list waiting for treatment, you die at home unable to even see a doctor.

Why must health care be rationed? You can’t provide unlimited use of something and expect that it won’t eventually consume all resources. Everything is rationed in some way; most things are rationed by money (others by law, etc).

So does that mean you will not receive some services that you want, or if you do, then you may have to wait? Yes. That is what it means; however, bear in mind that this is ALREADY the case. Public health care just changes the means of rationing. Besides, as shown below with life expectancy, rationing doesn’t seem to change health outcomes.

Why not let money continue to ration? I guess that is fine, except that our current course is unsustainable (costs too much), and what happens when you don’t have the money/lose your insurance (Medical bills prompt more than 60 percent of U.S. bankruptcies.)? Are you willing to risk that? US insurance is tied to jobs, and people change jobs a lot more than they used to…you will get caught in between at some point and find out that private health insurance is unaffordable (the same private insurance industry that says there is no need for reform).

Spin: We have the best health care in the world.

Fact: People with money have the best health care money can buy. On average we do not have the best health care in the world.

In fact, we are 50th in the world in life expectancy. Most/All the countries in front of us have some sort of government supported health care and so must also ration care in some form. Despite that (or perhaps because of it), they are in better health than us. Additionally, Cuba is 55th…with a life expectancy pretty much the same as ours (78 years).

Why is life expectancy an important metric? Easy: Shouldn’t all health care improve health? Isn’t the ultimate reason for being healthy to stay alive? You can argue about quality; however, quantity (life expectancy) is a good overall measure, and we are losing to other countries with socialized medicine.

Spin: The Free Market will save us. The answer to all economic questions is capitalism.

Fact: I can’t even begin to tell you how fed up I am with the free market religion.

Let’s talk about the free market incentives for the health care gatekeepers: Insurance companies. Ultimately, whether you get health care or not (at least in the US) is about whether or not you have insurance. Try paying cash. You’ll go bankrupt. (The reason for this is beyond the scope of this article.)

Here is how the free market is supposed to work (I’m self-selecting an example that shows free market incentives in a positive light): Mitsushiba (or any company) makes a TV. It is the best TV, but it is expensive. You don’t even really need a TV though; it is elective. You can do without. Still, Mitsushita is proud to offer an awesome TV at a good price, and they make a profit. They make the profit by selling you what you want (the ability to watch TV) for a price you are willing to accept (after all, there are other TVs and in the end you didn’t HAVE to buy a TV at all).

Now let’s examine the incentives of the health insurance industry: HealthCon (or any company) sells health insurance. It is expensive, and you HAVE to buy it (unlike a TV). There are a few other alternatives (a handful of major players nationally), but their prices are all similar (expensive), so it doesn’t much matter which one you go with. They make a profit as well, but not by providing you with the service you want (health care) in exchange for the money you provide. They make a profit ONLY if they deny you the service you have paid for. Let me repeat that: Health insurance companies only make a profit if they don’t provide health care (the very thing they are supposed to be in business for).

In short, to argue that the free market can save health care is simply….misinformed.

Spin: We need a limited public health option, if any. Any public option that competes openly with the private health insurance industry will eventually lead to nationalized medicine. (I’ve heard this poppycock many times as an argument against the public option.)

Fact: Left unencumbered, the public option would indeed compete with private health insurance. Why is that an issue? Isn’t competition good? The only scenario under which a public option competing with private health insurance would lead to nationalized medicine is if private health insurance couldn’t compete (ie. people CHOOSE to go with the public option because it was cheaper or better).

By arguing for a restricted public option, private insurers are basically saying “We couldn’t compete with an open public option. It would drive us out of business. We couldn’t make a profit.” Really? I thought anything government-run was inefficient and wasteful and private industry would always beat it. I guess big business is all for competition, as long as it doesn’t compete with them.

Also, there is no competition presently. Health insurance is an oligopoly…not much different in effect than an monopoly.

Spin: Governments are inefficient. They make a mess of any market they enter. Private industry is superior.

Fact: Let’s go one by one: “Governments are inefficient.” I agree they often are in practice, but that needn’t always be the case. If you look at admin costs as a percentage of health care expenditures for other countries; theirs comes in below the US’s private industry number. Also, it is a little two-faced for the health care industry to argue that governments are inefficent; private industry’s inefficiency (bulging costs) is how we got in this mess in the first place.

“Government makes a mess of any market they enter”: Again, no. Think of the FLSA (Fair Labor Standards Act). People (of any age) worked all day long in terrible conditions before the government stepped in to regulate. Governments do make messes…..but so does private industry (think financial meltdown); again, it is two-faced to say governments mess up markets when the private industry also messes up markets even without government intervention…..which then requires large government bailouts on the taxpayer dollar.

“Private industry is superior”: Taking my two examples above of TVs and Health Insurance, Private industry is good at providing TVs (when that set of incentives is in place), but bad at providing healthcare (the incentives are wrong).

Spin: Public health care costs too much.

Fact: Uhh…

Public health care will cost too much? Seriously, it ALREADY costs too much. That’s why we’re having this conversation in the first place. If that isn’t the pot calling the kettle black.

We already pay for it; we just don’t get anything out. If you mean public health care as it is in European countries, then it will cost LESS than it currently does. The reason we will never see that is that any system we put in place now will have to pander to the current system, so we’ll end up with some messy compromise.

Alternative Energy:

Alternative energy is important. Oil is not sustainable (nor are humans). We must make changes; however, some I think aren’t so well thought out.

Spin: Biofuels are the future!

Fact: If you mean turning corn, grass, or basically anything organically grown into fuel….its a terrible idea. Food prices will rise worldwide as that land is used to produce fuel instead of food. Those billions of people worldwide who barely have enough to eat care far more about corn or rice than they do about whether we can drive our Priuses around using biofuels. You can’t eat a Prius. You can quote me on that.

Spin: Batteries dude!

Fact: Batteries are not power, they store of power. I’m not arguing against more efficient batteries; I’m just saying batteries are not a substitute for oil….they are a complement. Oil produces electicity, which is stored in batteries.

To that end, oil itself can be thought of as a battery. It is storing power in the form of hydrocarbon bonds that we release to do work (eg. make energy, run cars, etc).

The difference is that nature, in the form of oil, has already gathered the energy, already stored it in a fairly stable form. In the case of batteries, we still need to provide the energy as input.

Again, batteries are not an alternative energy; they are an alternative store of energy.

Myth: Solar energy is the future! Nuclear power is the future!

Fact: Solar energy is the future! All life on earth is powered directly by the sun (plants) or indirectly by consuming things that are powered by the sun. Nuclear energy is the future! If all things on earth are powered by the sun…..what is the sun powered by? Nuclear energy.

Bottom Line, we should take note: Nature has a way of pointing out the most efficient mechanisms for things (except the wheel….how did it not invent the wheel?).

The Cost of Doing Nothing:

Spin: “It would’ve been worse if we had done nothing.” “We must act now; the cost of doing nothing is too great.”

Fact: I hear this all the time in the media, in politics, in business. Is the cost of doing nothing greater than the cost of acting now? The answer is easy: Impossible to say. Untenable.

We hear the cost of doing nothing argument currently about health care; we also heard it with the financial crisis.

People use the phrase as a way to promote expediency. “We must act now…or else!” Or else what?

The suggestion (or whatever we must act now on) may or may not have merit, but often it is simply impossible to prove what would’ve happened otherwise. What was the true opportunity cost that decision? We don’t know in most cases. You can search for analogies in the real world to try and see, but it is easy to argue those away.

In the end, the “cost of doing nothing” argument is a complete waste of breath. It doesn’t signify anything. It is unsupportable and does not promote dialogue. If you must do something then the merits stand on their own, not as an alternative to “or else”.

Tags: economics, healthcare

1 Comment » 1 Comment »

|

Entries (RSS)

Entries (RSS)